Don’t invest unless you’re prepared to lose all the money you invest. This is a high - risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more

Brighton & Hove Energy Services Co-operative

Renewable Energy - Bonds

122%

raisedForecast

return

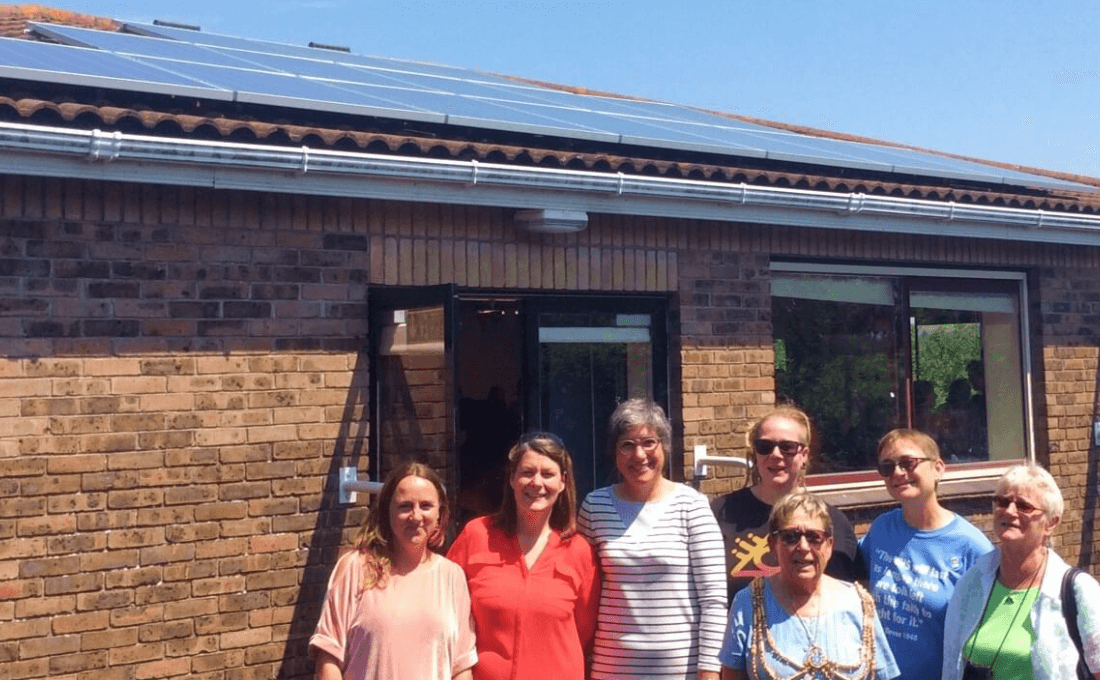

Brighton and Hove Energy Services Co-operative (BHESCo) is a not-for-profit social enterprise dedicated to accelerating the clean energy transition through their unique finance initiative and innovative technical solutions.

- Where your money goes

- Team

- Documents

- Updates

Updates

Bond Offer extension to 15-04-24

1st February 2024

Since its launch on 9th November 2023, Brighton and Hove Energy Services Co-operative's (BHESCo) bond offer has raised a very encouraging £276,000 towards funding a portfolio of new clean energy projects in Sussex. The bond offer was originally scheduled to close on 31 January 2024. As investments continue to flow in and as the offer is still some way off its target raise, BHESCo’s Board of Directors have made the decision to extend the offer period to 15th April 2024.

This Closing Date allows investors to make full use of their 2023/24 tax-free ISA allowance and provides an opportunity for those who wish to do so to invest using their 2024/25 ISA allowance. It is important to get as close as we can to the target raise to enable all of the projects in the portfolio to be installed and we believe that the target can be met within this extended time period.

The Board of BHESCo wishes to extend its thanks for your patience as it works to secure sufficient funding to deliver the full impact of this project portfolio.

Brighton & Hove Energy Services Co-operative

Society number: 32097R

Brighton

Incorporation date: 10 June 2013

Your money will…

Save schools money on energy bills by generating their own clean energy, that’s cheaper than they would otherwise pay.

Take decisive action to tackle climate change by enabling BHESCo to complete a new collection of carbon-reducing solar power projects.

Empower the next generation to understand sustainable energy by experiencing the benefits of solar energy generation first hand.

Earn a potentially tax-free return. Your investment will target a return of 5% and is eligible to be held within an IFISA*

The bigger picture

The recent energy crisis has shown how outdated and vulnerable the UK energy industry is. BHESCo believes that long-term affordable energy security requires local clean energy systems, owned by and run in the interests of the communities they serve. BHESCo have developed several new projects which introduce innovative solutions such as sharing solar electricity generation between neighbouring properties. The projects being developed as part of this bond offer are a continuation of BHESCo’s pioneering work which since 2015 has:

- Developed 59 community-focused carbon reduction projects

- Raised £1.5 million of investment to fund community energy initiatives

Achieved 7,655 tonnes of CO2 savings across the projects’ lifetimes

- Saved £2 million in energy costs across all projects

- Completed 2,000+ energy efficiency surveys

They have big ambitions to do much more and this bond offer will fund a further 8 solar projects – 5 of which are on schools – providing an estimated combined carbon dioxide savings from these projects equivalent to removing 279 cars from the road for a whole year.

*IFISA eligibility depends on investors' individual tax status and current legislation.

What your money will do

Your investment in BHESCo will:

- Fund BHESCo to install solar systems on 5 schools with a combined 260kWp capacity

Save the schools £3.1 million on energy bills and mitigate 2,700 tonnes of CO2 over the lifetime of the solar arrays

- Fund a further three carbon-saving solar projects on SMEs in the Sussex area

- Support the development of an innovative solar electricity shared distribution system between neighboring SMEs.

Team

BHESCo is determined to build on this successful model and this share offer will help them fund the next phase of their work: https://bhesco.co.uk/

Kayla Ente MBE

Founder and CEO

BHESCo’s founder and CEO, started her career with Deloitte & Touche, later moving to Ernst & Young in Amsterdam. She has worked for Greenpeace International and Ecofys, a pioneering renewable energy engineering consultancy. She started developing renewable energy projects in 2000 for Nuon, a Dutch energy supplier. She won the Nuon Sustainability prize for her idea to lease renewable energy systems using a Pay as You Save model. She is a qualified accountant and MBA, bringing a wealth of experience to the team. Kayla has been a director of Retrofit Works, and was awarded an MBE in 2021 for her services to community energy efficiency.

Mark Kenber

Non-Executive Director

Mark was previously CEO of Mongoose Energy – a company that provided asset management, project development and finance services to the community energy sector. Prior to joining Mongoose, Mark had been with international climate change NGO The Climate Group for nearly 12 years, latterly as CEO. During his time with the organisation he oversaw the launch of the Verified Carbon Standard, We Mean Business coalition and RE100 campaign and was an expert advisor to former UK Prime Minister Tony Blair on the joint policy initiative Breaking the Climate Deadlock. Mark is now Executive Director of The Voluntary Carbon Markets Integrity Initiative (VCMI)

Diane Smith

Operations Director

Diane has been a finance professional for more than 25 years. After running treasury operations for The Economist Newspaper in London, she moved to the Netherlands to set up Nike’s European foreign exchange risk management programme and then to Belgium to lead operational support teams and IT project managers at BNY Mellon (a US investment company). She has been working in the renewable energy sector since 2014

Garry Fellgate

Non Executive Director

Garry has a strong business and policy background in energy, environment and sustainability, built-in corporate organisations (IBM, Landmark Graphics), and leading consultancies (KPMG, A. T. Kearney). He was formally CEO of the Energy Retail Association. Nowadays he supports start-ups operating in the clean energy sector, supports the Department for Energy Security and Net Zero on their Energy Entrepreneurs Fund programme, Innovate UK and several advisory groups.

Paul Beckett

Non Executive Director

Paul is co-owner and co-founder of the multi-disciplinary environmental consultancy Phlorum, which he set up with a colleague in 2003. Before then he cut his teeth in environmental consultancy at WSP and RPS. As a consultant, he has completed environmental impact assessment work on a very broad range of projects, from housing developments to energy production, warehousing, sewage treatment, various industrial processes and transportation infrastructure schemes

Rachel Espinonsa

Energy from Waste Director

Rachel is an expert in waste management operations, strategic planning & development. She has worked in the waste industry for more than 20 years as a waste services manager and consultant and is a partner of Re-consult LLP. She is a Centre Councillor for the London and South Counties Centre of the Chartered Institution of Wastes Management.

Team Member Name 7

Team Member Position 7

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 7

Team Member Name 8

Team Member Position 8

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 8

Team Member Name 9

Team Member Position 9

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 9

Team Member Name 10

Team Member Position 10

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 10

Team Member Name 11

Team Member Position 11

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 11

Team Member Name 12

Team Member Position 12

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 12

Interest accrual and payment

Bond interest payments will start on the anniversary of the issue date in each calendar year with the first payment falling in 2025

Getting your money out

A bondholder may apply to redeem their bonds in whole or in part as at 31 March in any year and in order to do so shall complete a Repayment Notice and return the same to BHESCo so as to be received by BHESCo at least 3 months prior to the proposed Repayment Date

Any redemption shall be at the Directors’ absolute discretion and may be for a number of bonds less than those applied for in the Repayment Notice. Any such redemption shall be at par, together with interest accrued on redeemed bonds up to and including the date of redemption.

Investing on behalf of children

Applicants must be 18 years old or older and investments cannot be made on behalf of children.

Interested in Renewable Energy investments?

Get notified via email when new investments go live