Don’t invest unless you’re prepared to lose all the money you invest. This is a high - risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more

Fair Tax Foundation

Ethical Finance - Community Shares

110%

raisedForecast

return

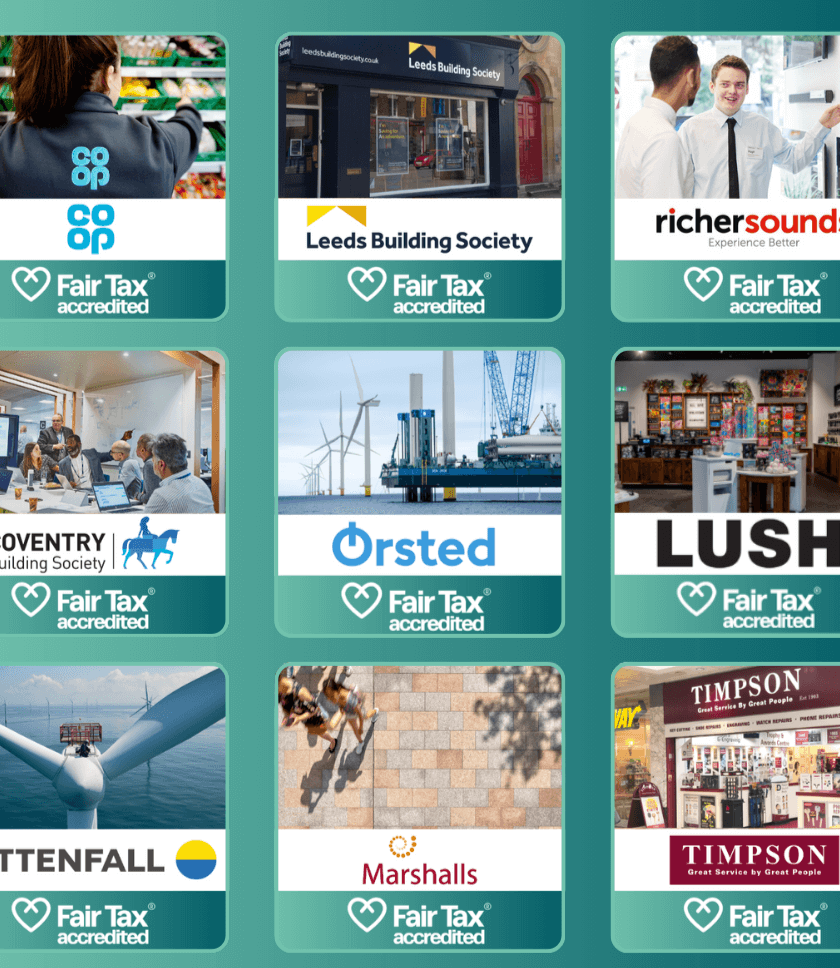

The Fair Tax Foundation aims to help reverse the global race to the bottom on corporation tax. Its Fair Tax Mark is now the gold standard of responsible tax conduct. It has grown a movement of progressive businesses that are proud to pay their taxes and celebrate the enormous contribution this makes to public services.

- Where your money goes

- Team

- Documents

- Updates

Updates

Friends Provident Foundation invests in Fair Tax

7th November 2024

Joseph Rowntree Foundation invests in Fair Tax Foundation

6th November 2024

Barrow Cadbury Trust boost Fair Tax Foundation community share offer by £100,000

16th September 2024

Fair Tax Foundation Limited

Society no. 32308R

Manchester, UK

Incorporation date: 18 February 2014

Your money will…

Tackle corporate tax avoidance by promoting responsible tax conduct and encouraging legislation to challenge businesses that shun their tax obligations

Enable businesses to compete fairly by championing those enterprises that shun tax havens and follow the spirit as well as the letter of the law

Improve essential public services by working to plug the UK’s £12.5bn corporation tax shortfall, and similar shortfalls elsewhere

Earn a potential return. Investments in the share offer target an initial annual return of 6%, and UK base rate plus one percent thereafter

The bigger picture

What your money will do:

Your investment in the Fair Tax Foundation share offer will:

- Enable the Fair Tax Foundation to create a new sales and business development team, broaden its product offering, expand its back-office operations, and recruit and train new technical staff.

- Fund the growth needed to increase its income from around £500,000 to around £2mn per year, in turn boosting its positive impact on society.

- Quintuple its corporate engagement in the UK and overseas, leading to hundreds of Fair Tax Mark accredited companies combining to make a corporation tax contribution in excess of £8.5bn per annum.

- Help the Fair Tax Foundation and its movement of progressive businesses to turn around the corporate tax race to the bottom - inspiring governments to raise legislative baselines and regulators to implement rules more robustly.

Team

The Fair Tax Foundation was launched in 2014 and operates as a not-for-profit social enterprise. It believes companies paying tax responsibly should be recognised and celebrated, and any global race to the bottom on tax competition should be resisted. https://fairtaxmark.net/

Paul Monaghan

Chief Executive

Paul was a co-founder of the Fair Tax Foundation in 2013, and became Chief Executive in September 2017. He previously led, for two decades, award-winning sustainability programmes across the Cooperative Group in areas as diverse as Food, Banking, Insurance, Pharmacy, Funerals and Travel.

Jaime Boswell

Head of Accreditation

Jaime comes from both an accounting and taxation background, with professional qualifications and experience in both. He joined in 2020, and previously worked for a range of accountancy firms from small family businesses to one of the largest in the world.

Tom Skinner

Chief Operating Officer

Tom joined in 2022, and previously co-founded Greater Manchester Poverty Action where he was co-Director and Chief Operating Officer for five years. He managed several programmes and campaigns alongside responsibility for the organisation’s operations and finances.

Natasha Turner

Acting Head of Communications

Natasha joined in 2024, and previously spent nearly a decade in journalism. She has launched and run several financial publications, before moving into communications. Prior to joining the Fair Tax Foundation, she was global editor of ESG Clarity.

Rob Harrison

Board Member - Chair

Rob Harrison is a director of Ethical Consumer Research Association (ECRA) and was also a co-founder of the Fair Tax Foundation. He has been an editor of Ethical Consumer Magazine since its inception in 1989, and has made a major contribution to academic work in this area.

Chris Harrop OBE

Board Member

Chris Harrop is Visiting Professor of Sustainable Business at the University of Huddersfield. Previously, he was Director of Marketing and Sustainability at Marshalls plc for 22 years, and Chair of Made on Britain, 2017 to 2024.

Harriet Lamb CBE

Board Member

Harriet Lamb is the Chief Executive Officer of WRAP, the climate action NGO. She previously headed up Fairtrade in both the UK and internationally, and authored Fighting the Banana Wars. She was named Orange Businesswoman of the Year in 2008.

Rachel McEwen

Board Member

Rachel is Director of Sustainability at SSE Plc, and is responsible for its sustainability strategy, partnership funding and corporate heritage. She is also Chair of Living Wage Scotland’s Business Leadership Group and was Senior Special Adviser to Scotland’s First Minister, 2001 to 2007.

Christian Hallum

Board Member

Christian Hallum co-leads Oxfam’s tax justice work internationally, and is based in Denmark. He has previously worked with Tax Justice Network Africa in Kenya, IBIS in Sierra Leone and Eurodad in Belgium. He has also worked with the Danish tax administration SKAT as a compliance analyst.

Team Member Name 10

Team Member Position 10

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 10

Team Member Name 11

Team Member Position 11

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 11

Team Member Name 12

Team Member Position 12

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud. 12

Interest accrual and payment

Annual interest paid from 31st December 2025. Interest will be added each year to share capital accounts in the form of new community shares.

Getting your money out

Shares are not transferable. In 2031 and 2032, 50% of total share capital will be available to withdraw each year (including accrued interest). Subject to board agreement.

Investing on behalf of children

Anyone 18 years or older can invest through this offer. Investments cannot be made on behalf of children.

Interested in Ethical Finance investments?

Get notified via email when new investments go live